The Single Strategy To Use For Custom Private Equity Asset Managers

Wiki Article

Custom Private Equity Asset Managers Fundamentals Explained

With its substantial industry know-how, the personal equity group companions with the administration group to boost, optimize, and scale the service. Remember, numerous of the financiers in the exclusive equity groups have been drivers, or a minimum of have worked together with drivers, in the pertinent sector, so they can capably assist management with the successful execution of vital campaigns within business.

The option of selling to private equity teams certainly involves trying to find the very best rate, yet it also includes weighing long-term advantages. Keep in mind, there is the gain from the initial sale, but additionally the proceeds from the ultimate sale of the rollover financier's continuing to be equity. With personal equity customers, your organization can check out lucrative possibilities it might not or else have access to.

An additional development opportunity that private equity teams might pursue is growth via buy-side M&A, implying selective and very calculated add-on procurements. TX Trusted Private Equity Company. The ultimate goal of private equity groups (and of offering to personal equity teams) is to expand and grow the firm's beneficially, and one means to do that is via add-on acquisitions

In order to see this benefit, if add-on acquisitions are expected, make sure to review the exclusive equity team's experience and success in acquiring these sorts of add-ons, including the effective succeeding assimilation (or not) of those acquisitions into the original company. In the ideal circumstances, there are clear advantages to marketing to an exclusive equity group.

Not known Details About Custom Private Equity Asset Managers

That will certainly not necessarily be the customer who provides the greatest list price for the company today. Bear in mind, there are two sales to think about: the initial sale to the exclusive equity group and the future sale when the exclusive equity group offers its and the rollover investors' staying stake in business at a future departure.

We aid sellers identify private equity financiers with experience and links that relate to your business, and we can aid make certain that the financiers and your management group are aligned in their vision for future development for the business - https://peatix.com/user/20144170/view. If you would love to review the idea of marketing to a personal equity team, connect to us

You'll be close to the activity as your company makes deals and gets and sells firms. Your associates will certainly be well educated and creative, and each PE task provides a different set of obstacles that you must get rid of. It's tough to land an entry-level work unless you attended a top-tier university or have connected experience in the hedge fund or financial investment banking industries.

go to the website7 percent of senior-level settings in exclusive equity firms as of March 15, 2015, according to Preqin (an alternate investment study firm)a portion that's considerably lower than their representation in the overall U.S.

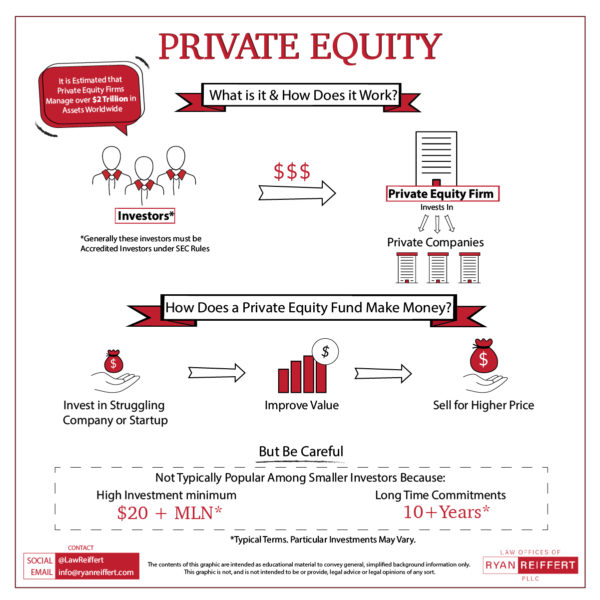

Like any other businessVarious other organization private equity exclusive's primary goal is objective make money, cash they do that by purchasing individual buying and selling those marketing in companies future for more money than cash original purchase priceAcquisition A simplified way to believe regarding this is the "earnings" of a private equity firm is the business worth of a business when they offer it, and the "expenses of products offered" is the venture worth of the business when they purchase it.

Possession administration costs are typically around 2% of properties under administration (Private Asset Managers in Texas). As an example, a $500 million fund would certainly earn $10 million in these costs annually. Performance costs, or lugged passion, commonly average around 20% of make money from investments after a certain standard price of return is fulfilled for minimal companions and even greater earnings when greater return obstacles are accomplished

These conferences can assist companies enhance by finding out from others facing similar challenges in the marketplace. If not already in position, exclusive equity companies will seek to develop a board of supervisors for the company. Leveraging industry and service links, they have the ability to hire board members who have extensive insight into areas such as the company's end markets and customers that can help enhance business moving forward.

The smart Trick of Custom Private Equity Asset Managers That Nobody is Discussing

In Section 3 we take the perspective of an outdoors capitalist investing in a fund sponsored by the exclusive equity firm. Meanings of personal equity vary, yet below we consist of the whole asset course of equity financial investments that are not estimated on securities market. Personal equity stretches from equity capital (VC)collaborating with early-stage firms that might be without revenues yet that possess good concepts or technologyto growth equity, offering capital to increase well-known exclusive organizations frequently by taking a minority passion, all the way to large acquistions (leveraged buyouts, or LBOs), in which the exclusive equity firm buys the whole firm.

Buyout deals usually include private firms and extremely frequently a certain department of an existing business. Some exclude endeavor capital from the private equity universe due to the higher threat profile of backing new firms rather than mature ones. For this analysis, we refer simply to financial backing and buyouts as both main types of exclusive equity.

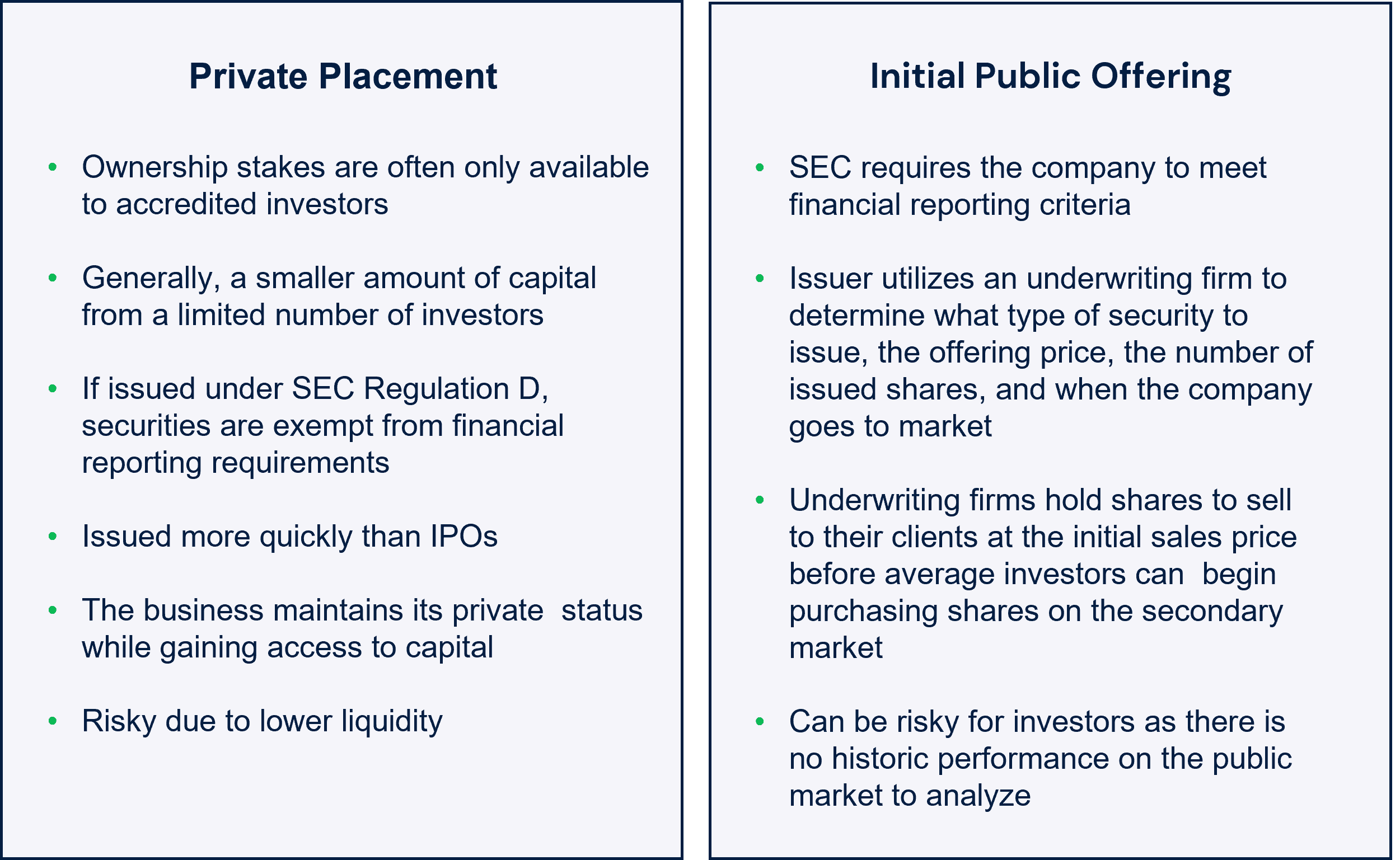

Growth Development capital Funding to established and mature firms in exchange for equity, frequently a minority risk, to expand into brand-new markets and/or improve operations Acquistion Acquisition resources Funding in the form of financial debt, equity, or quasi-equity offered to a business to get one more firm Leveraged buyout Funding provided by an LBO firm to get a company Administration acquistion Funding given to the administration to get a company, particular line of product, or division (carve-out) Special situations Mezzanine financing Funding normally given in the form of subordinated debt and an equity kicker (warrants, equity, etc) often in the context of LBO transactions Distressed/turnaround Financing of firms seeking restructuring or dealing with financial distress One-time chances Funding in relationship to changing industry trends and brand-new federal government regulations Other Other forms of private equity financing are also possiblefor example, protestor investing, funds of funds, and secondaries. - TX Trusted Private Equity Company

Report this wiki page